The Rental Deposit Account and Its Alternatives

When renting an apartment, it is usually necessary to set up a rental deposit account. This is an essential part of the rental agreement that protects both the landlord and the tenant. But are there alternatives to the rental deposit account? Let's take a look.

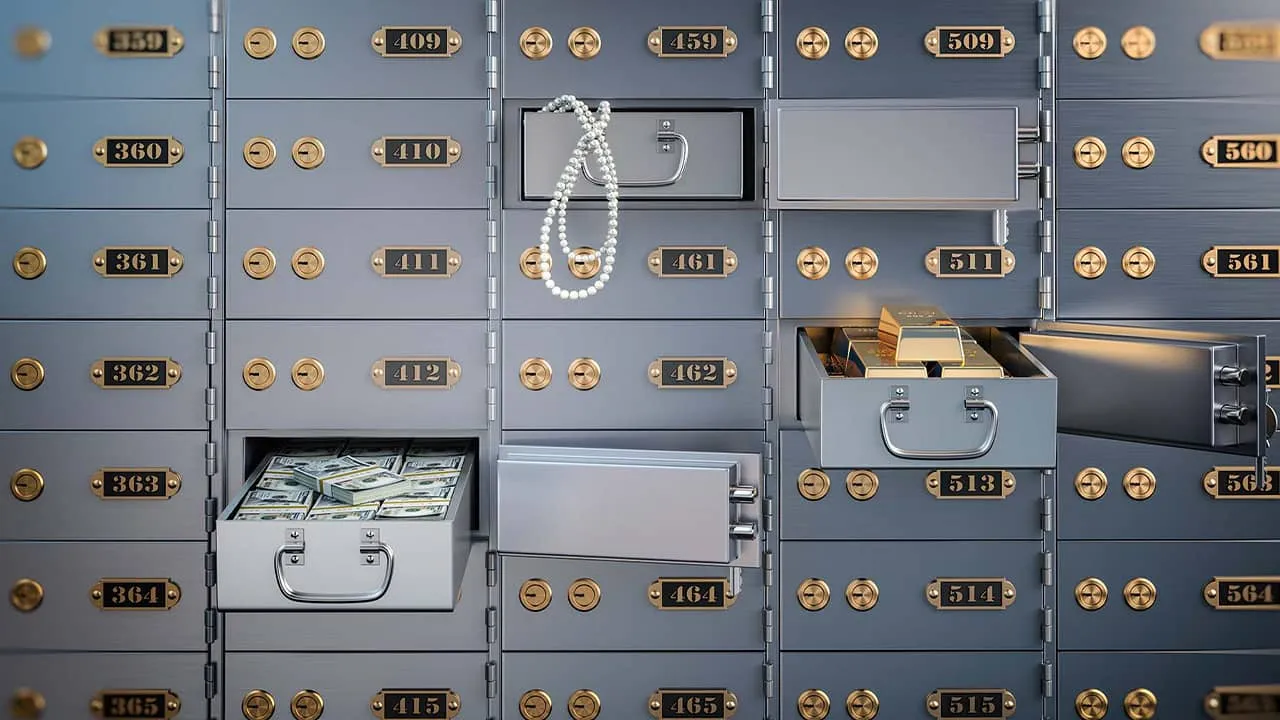

What is a Rental Deposit Account?

Before we explore alternatives to the rental deposit account, let's first clarify what a rental deposit account is. It is a special bank account where the tenant deposits a security deposit. The money in the rental deposit account serves as security for the landlord in case the tenant fails to fulfill their contractual obligations, such as unpaid rent or damages to the apartment.

The main advantage of the rental deposit account is that it separates the deposit from the landlord's assets, ensuring that the money is available when needed. Setting up a rental deposit account is legally required and an important part of the rental agreement.

The Alternative to the Rental Deposit Account: The Rental Deposit Guarantee

An interesting and increasingly popular alternative to the traditional rental deposit account is the rental deposit guarantee. In this case, a guarantee is provided by a third party, usually a bank or insurance company. It protects the landlord against the same risks as the deposit in the rental deposit account, without the tenant having to come up with a large sum of money.

Advantages and Disadvantages of the Rental Deposit Account compared to the Rental Deposit Guarantee

Although the rental deposit account is the traditional way to deposit the security deposit, it also has some disadvantages. The biggest disadvantage is that the tenant has to come up with a larger sum of money all at once. This can be a challenge, especially during a move when many expenses are already incurred.

In comparison, the rental deposit guarantee allows for greater financial flexibility. Instead of depositing a large sum of money into a rental deposit account, the tenant only pays an annual or monthly fee for the guarantee.

FAQ about the Rental Deposit Account

How is a rental deposit account set up?

The tenant usually sets up a rental deposit account. A special bank account is opened, and the deposit is deposited into it. It is important that the rental deposit account is in the tenant's name, and the landlord only has access to the money in case of contractual violations.

What happens to the money in the rental deposit account after the end of the tenancy?

After the end of the tenancy and after deducting any claims, the money in the rental deposit account is refunded to the tenant. The landlord must close the rental deposit account, including any accumulated interest, and transfer the money to the tenant.

Can I use a rental deposit guarantee instead of a rental deposit account?

Yes, the rental deposit guarantee is an accepted alternative to the rental deposit account. However, the landlord must agree to the guarantee. Therefore, it is advisable to discuss the various options with the landlord before signing the rental agreement.

In summary, the rental deposit account is an essential part of any tenancy. However, there are alternatives such as the rental deposit guarantee that can offer tenants more financial flexibility. It is worth considering both options and finding the most suitable solution for your own situation.

What happens to the interest on the rental deposit account?

The rental deposit account usually earns interest. The interest accrued on the rental deposit account belongs to the tenant. When the tenancy ends and the deposit is refunded, both the deposit and the accumulated interest are paid out to the tenant.

How long does it take to receive my money from the rental deposit account?

After the tenancy ends, the landlord must close the rental deposit account, including any accumulated interest, and transfer the money to the tenant. The exact duration may vary, but the refund should generally be made within six months, unless the landlord makes any claims.

What is the maximum amount for the rental deposit account?

The deposit deposited into the rental deposit account may not exceed three times the net cold rent. This is legally stipulated and applies regardless of whether the deposit is paid in a lump sum or in installments.

Can the landlord directly access the money in the rental deposit account?

No, the landlord does not have direct access to the money in the rental deposit account. The landlord can only access the deposit if the tenant fails to fulfill their contractual obligations, such as unpaid rent or damages to the apartment. Even after the tenancy ends, the landlord must provide evidence of any claims against the tenant before accessing the deposit.